How Does Solar Save Money?

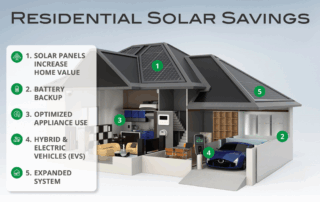

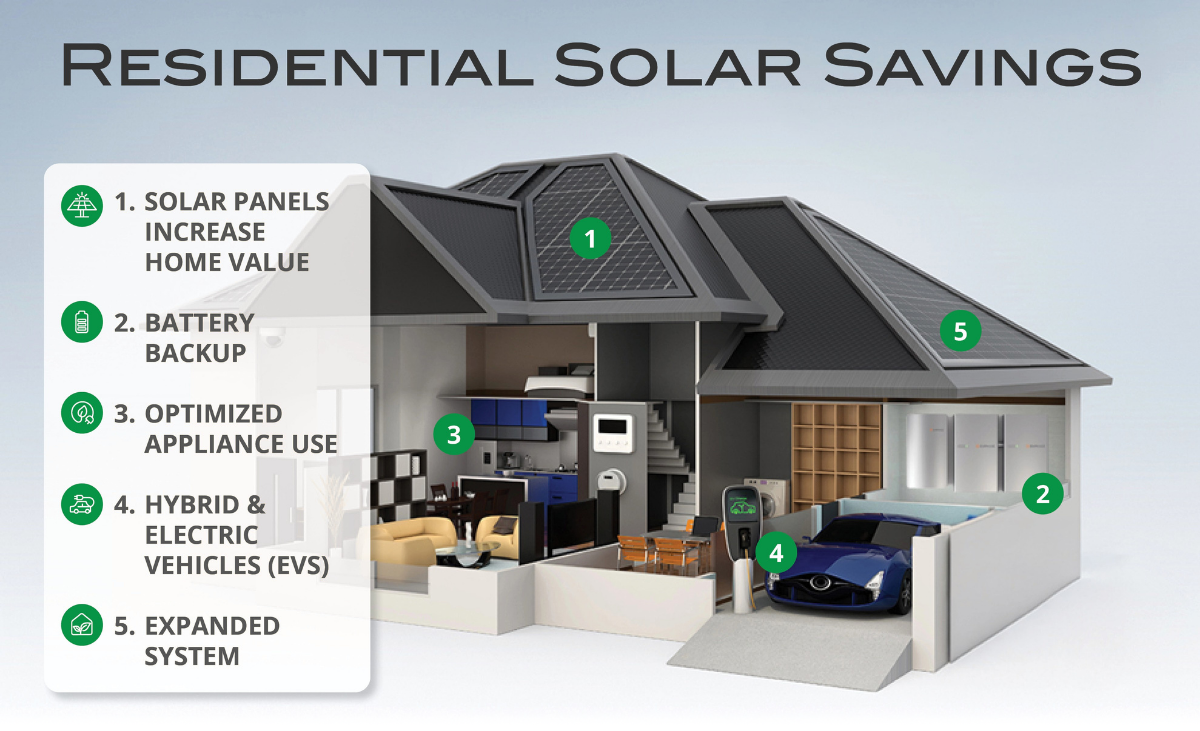

We all know that using renewable solar energy helps protect our natural resources. But it also allows you to take advantage of the financial benefits that come with it—from increasing the value of your home to getting tax rebates and saving some cash on everyday activities.So what does that look like in action? Here’s a closer look at the benefits of a residential solar ecosystem:Solar Panels Increase Home Value: Average residents of northern California pay over $300 a month for electricity from PG&E. Going solar eliminates that bill, while at the same time increasing your home's value up to 7%.Battery Backup: Streamline and optimize your entire solar [...]

Top Solar Incentives for Bay Area Homeowners

If you own a home in the Bay Area, you likely value both financial efficiency and environmental responsibility. Installing solar panels can deliver on both fronts—significantly cutting energy costs while shrinking your carbon footprint. Yet even with today’s advanced solar technologies, the upfront expense of a quality installation can feel like a hurdle. That’s where solar incentives come in. These federal, state, and local programs—ranging from tax credits and rebates to energy credits and financing solutions—can substantially lower the initial financial barriers. By leveraging these incentives, you can gain a faster return on your solar investment, add long-term value to [...]

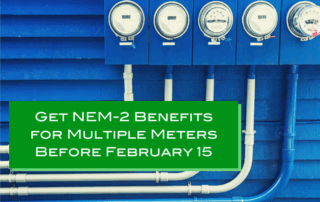

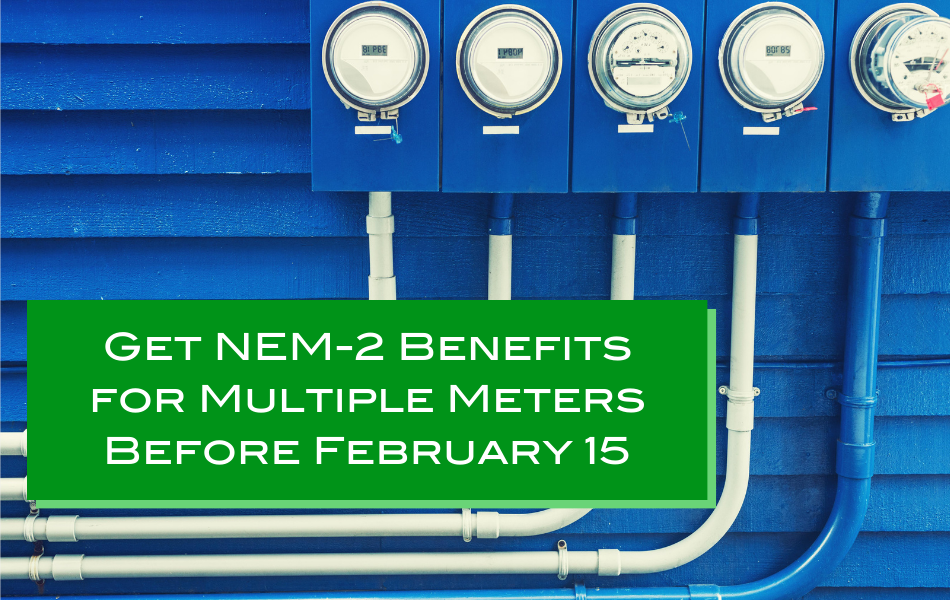

You Might Still Qualify for NEM2A

Have you ever wished you could go back in time to save yourself some money on a good decision? Good news! Now is one of those times. If you have more than one PG&E meter on your property, or on adjacent or contiguous properties, you may qualify to receive the benefits of the now-defunct NEM-2 legislation. This presents a wonderful chance if any of the following conditions apply to your property: Accessory dwelling units (ADUs) A well Any other additional meter Plus, it’s valid for both residential and commercial systems. But don’t wait to find out if you qualify—the cutoff date for this legislative loophole is February 15, 2024. Contact us [...]

SOLAR SAVINGS ARE HERE TO STAY

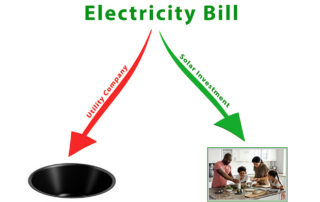

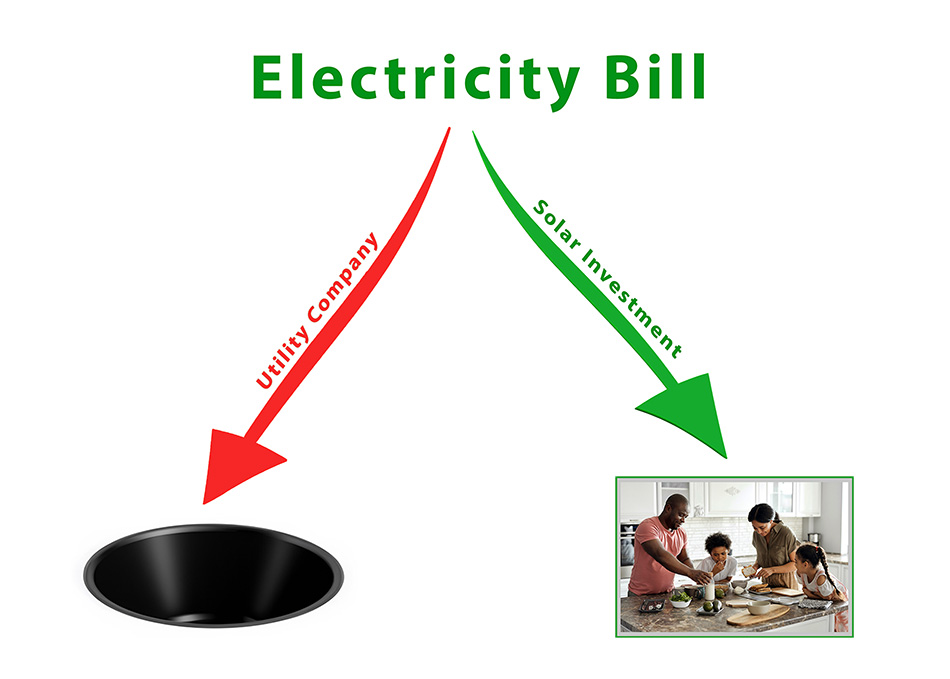

Solar Family, if you’ve been considering switching to solar energy but are hesitant, now is a great time to make the switch. With California's net billing tariff (NBT) program, you can eliminate your electric bill and save thousands annually by installing solar for your home. Take a look at this real example from a recent homeowner who installed solar under the program through PG&E. REAL EXAMPLE Without Solar With Solar Monthly Bill $275–$679 $10–$20 Yearly Increase 4%–10% No Return on Investment No Yes Yearly Savings No Yes Like the example above, we'd like to help you and [...]

How the New CA Solar Policies Affect Your Savings

On December 15, 2022, the California Public Utilities Commission (CPUC) unanimously voted to approve a new Net Billing tariff (NBT), the latest policy for Net Energy Metering (NEM) for solar. If you are or plan on being a California solar owner, you need to understand how the NEM 2.0 and NBT policies affect you. The Purpose of Net Energy Metering Net Energy Metering was introduced to reduce costs for energy companies and to maximize the energy produced by solar owners. A solar array will generate energy during sunlight hours. An owner wouldn’t need that energy until getting home from work, [...]

Apply for NEM-2 Before It’s Too Late

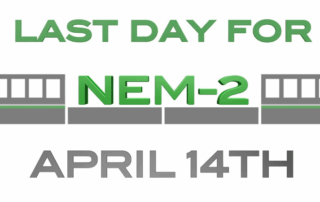

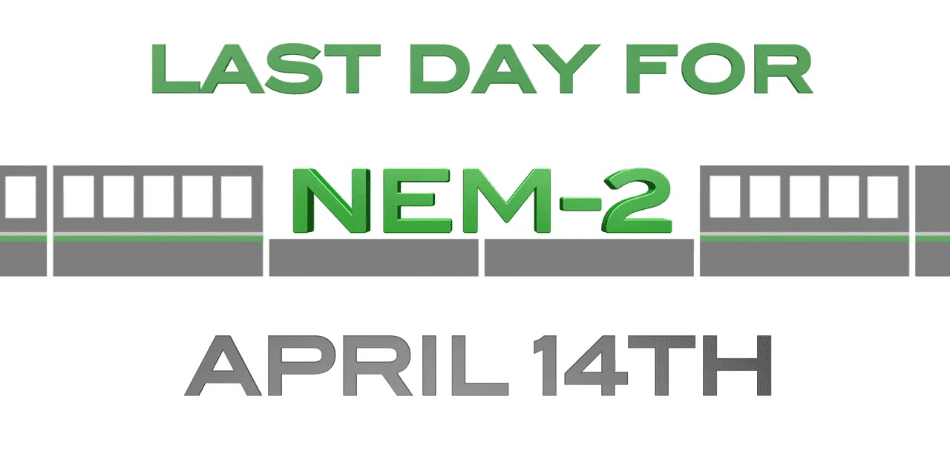

Hurry, Solar Family—time is running out to be grandfathered into NEM-2 benefits before it's gone forever. Let us help you submit the required documents to PG&E by April 14, 2023, to get you locked in and maximize your savings. Here’s what is required from PG&E to begin: Signed solar contract Submitted NEM-2 application That’s it! You don’t need a permit, final inspection, or full installation to get NEM-2. In fact, you have until April 15, 2026, to complete the project and retain NEM-2 eligibility. We're dedicated to helping you complete these steps before the clock runs out. If you’re ready to start your solar future, contact us [...]

News Alert: The NEM-3 Deadline Is Approaching

New solar legislation is officially on its way. On December 15, 2022, California legislature signed off on the new net energy metering (NEM) deal—and now, the clock is running out to be grandfathered into NEM-2. Here’s what you need to know: NEM-3 will begin on April 15, 2023, for all new solar customers who submit a completed NEM application on or after that date. (Current customers will remain on NEM-2.) Current NEM-2 customers who want to add more panels to their system before the April 15 deadline should reach out now to avoid losing their NEM-2 status. Monthly fees will be higher under [...]

Thank You for Shining With Us

We’ve put in a lot of work together this year, Solar Family. As 2022 draws to a close, we wanted to take a minute to thank you for being in this thing with us. We’ve arranged solar panels, installed battery backups, and helped so many people generate more clean energy—people like you. And it’s been well worth it. This year, we surpassed 10 gigawatt hours of generated power across all systems. That's over 10 billion watt hours! Thanks again for being part of our solar family. Your business is greatly appreciated, and we hope to see you on our next [...]

Inflation Reduction Act Secures a Greener Future for All

Solar power users are celebrating a win for green energy—and keeping more green in their pockets. This month, the US government passed the Inflation Reduction Act (IRA), which introduces $369 billion in budgeted energy and climate spending. It aims to increase US energy independence as well as lower clean energy costs for all Americans. In fact, $9 billion has been allotted to consumer home energy rebate programs alone. What does this mean for consumers? Our solar investment tax credits for your year of purchase have been raised from 26% to 30%—and secured for all new buyers for the next 10 years. Plus, people who go solar [...]

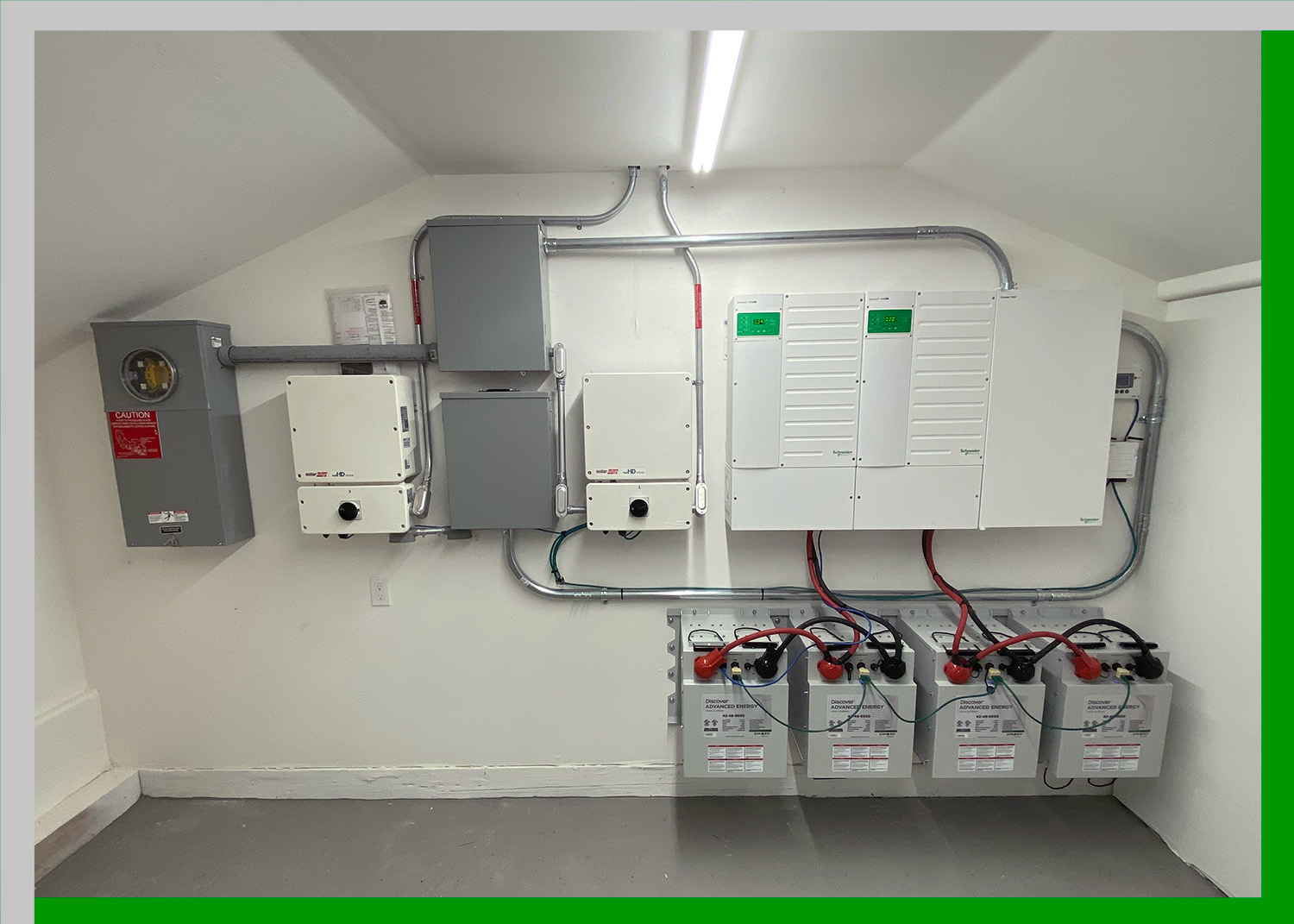

Energy Storage in California: Rebates & Incentives

Are you a California homeowner who’s interested in using a solar storage battery system with your panels? Well, 2021 is your year. You now have more incentives to install a solar battery than ever before. The state’s top energy storage rebate incentive program, the SGIP, underwent a major overhaul recently that makes it easier for residents to save money on battery installation. Selling excess power back to the grid isn’t the only way homeowners can see a return on their energy investment. With this program, homeowners with a solar system have the opportunity to expand their system to include storage [...]

We all know that using renewable solar energy helps protect our natural resources. But it also allows you to take advantage of the financial benefits that come with it—from increasing the value of [...]

If you own a home in the Bay Area, you likely value both financial efficiency and environmental responsibility. Installing solar panels can deliver on both fronts—significantly cutting energy costs while [...]

Have you ever wished you could go back in time to save yourself some money on a good decision? Good news! Now is one of those times. If you have more than [...]

Solar Family, if you’ve been considering switching to solar energy but are hesitant, now is a great time to make the switch. With California's net billing tariff (NBT) program, [...]

On December 15, 2022, the California Public Utilities Commission (CPUC) unanimously voted to approve a new Net Billing tariff (NBT), the latest policy for Net Energy Metering (NEM) for solar. [...]

Hurry, Solar Family—time is running out to be grandfathered into NEM-2 benefits before it's gone forever. Let us help you submit the required documents to PG&E by April 14, 2023, to get you [...]

New solar legislation is officially on its way. On December 15, 2022, California legislature signed off on the new net energy metering (NEM) deal—and now, the clock is running out [...]

We’ve put in a lot of work together this year, Solar Family. As 2022 draws to a close, we wanted to take a minute to thank you for being in [...]

Solar power users are celebrating a win for green energy—and keeping more green in their pockets. This month, the US government passed the Inflation Reduction Act (IRA), which introduces $369 [...]

Are you a California homeowner who’s interested in using a solar storage battery system with your panels? Well, 2021 is your year. You now have more incentives to install a [...]